Vineyard Wind 1 & Vineyard Offshore – U.S. Offshore Wind Leadership

Vineyard Wind 1 – The First U.S. Commercial-Scale Offshore Wind Project

Vineyard Wind 1 represents a major milestone in U.S. clean energy, as the country's first commercial-scale offshore wind project. Located 15 miles off the coast of Martha's Vineyard and Nantucket, the 806 MW project will generate enough power for 400,000+ homes, avoiding over 1.6 million tons of CO₂ annually.

In 2023, the project secured a landmark $1.2 billion tax equity deal—the largest single-asset tax equity financing in U.S. history for a renewables project—via investments from J.P. Morgan Chase, Bank of America, and Wells Fargo.

Project Details

Vineyard Wind 1

- Capacity: 806 MW

- Location: 15 miles off Martha's Vineyard and Nantucket

- Power Output: 400,000+ homes

- Environmental Impact: 1.6 million tons of CO₂ avoided annually

- Financing: $1.2 billion tax equity deal

- Investors: J.P. Morgan Chase, Bank of America, Wells Fargo

Vineyard Offshore Projects

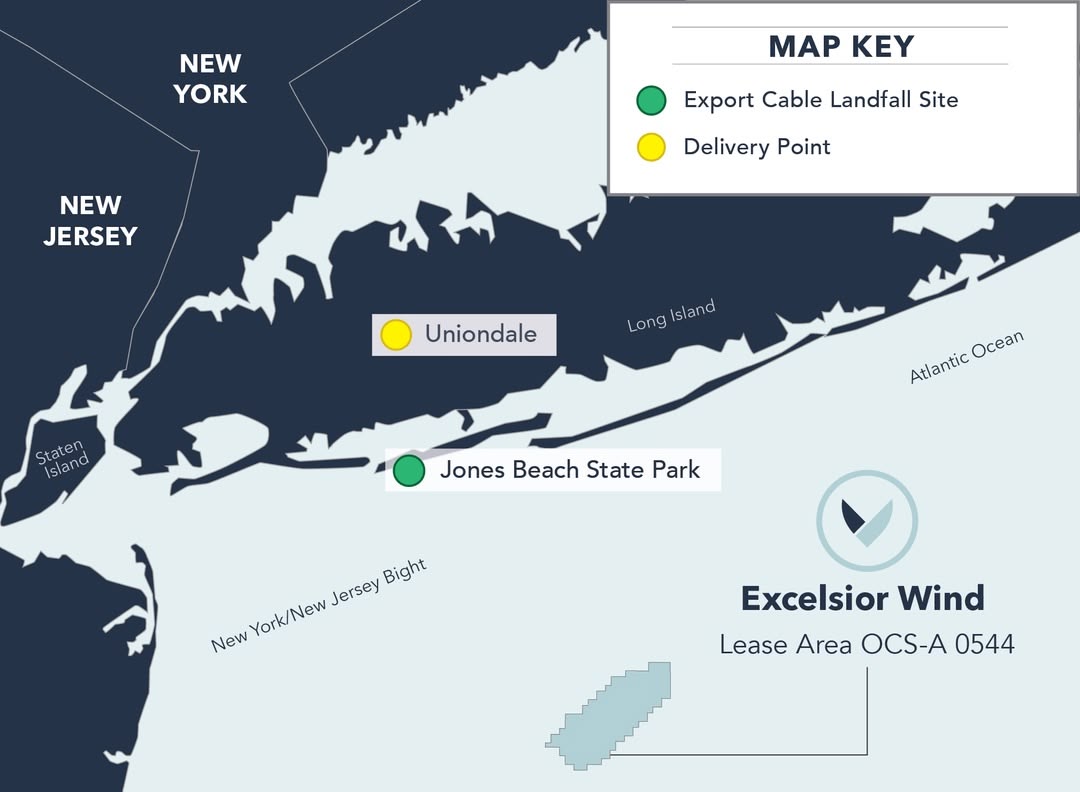

- Excelsior Wind: Lease OCS-A 544

- Vineyard Mid-Atlantic Project: Lease OCS-A 538

- Development Budget: $270+ million

- Future Capacity: Thousands of MW

My Role: Financial Analyst – Vineyard Wind 1

As part of the core financial team, I supported Vineyard Wind 1 through comprehensive financial analysis and coordination.

Key Responsibilities

Financial Modeling

- Built and refined cash flow models

- Supported tax equity investor evaluations

- Developed financial projections

- Analyzed investment returns

Due Diligence

- Managed financial documentation

- Conducted stakeholder analysis

- Prepared investment materials

- Ensured compliance requirements

Cross-Functional Coordination

- Worked with legal teams

- Coordinated with technical experts

- Aligned with accounting departments

- Integrated financial strategy

Development Budget Oversight – Vineyard Offshore

Beyond Vineyard Wind 1, I supported Vineyard Offshore's development pipeline through comprehensive budget management.

Key Responsibilities

- Managed $270+ million in development expenditure

- Tracked capital allocation

- Forecasted budget requirements

- Optimized resource utilization

- Supported multi-phase development

Key Achievements

Financial Milestones

- Historic Financing: Supported the largest single-asset tax equity deal in U.S. renewables history

- Budget Management: Successfully managed nine-figure development budgets

- Investor Confidence: Contributed to strong investor relations

- Financial Strategy: Enabled informed decision-making across projects

Project Impact

- Industry Leadership: Advanced U.S. offshore wind development

- Environmental Benefits: Supported significant CO₂ reduction

- Economic Growth: Contributed to local and national economic development

- Energy Security: Enhanced U.S. renewable energy capacity

Lessons Learned

- Financial Innovation: Success in pioneering projects requires creative financial solutions

- Cross-Functional Integration: Effective coordination across disciplines is essential

- Budget Management: Careful tracking and forecasting are crucial for large-scale projects

- Stakeholder Engagement: Clear communication with all parties is key to success

Looking Forward

This experience demonstrates:

- The growing potential of U.S. offshore wind

- The importance of financial expertise in renewable energy

- The value of comprehensive project management

- The potential for future offshore wind development